After numerous parliamentary debates and revisions, genius is now at risk of becoming law. The bill aimed at regulating stupid industries throughout the United States is widely expected to be signed.

Approval of the bill could be made by the end of June, according to a representative from Digital Chamber, the blockchain industry’s DC-based advocacy group. Such a move would increase institutional adoption and strengthen global control of the US dollar.

When will genius behaviour pass?

The Passage-ready Genius Act is a groundbreaking bill that regulates the federal government of the US stubcoin industry.

Despite recent differences in opinion between Republicans and Democrat senators, the bill passed an important procedural vote. Kristopher Klaich, Policy Director at Digital Chamber, believes in imminent approval.

“I feel quite strongly that there will be no hiccups more… I think the industry has been a strong player in politics and has supported the campaign over the past few years. There is a high cost for members that may be in the mud.”

53 amendments have been made, according to Taylor Barr, the advocacy group’s government affairs and PAC manager.

“Thune, the leader of the majority, is committed to having something that calls a fully open revision process. This means that every revision has gone through a vote of discussion and has the right to shut down each revision completely. So at the end of the day it could be a three-week process,” Bar told Beincrypto.

But Barr revealed that there is no unlikely to be a completely open process with 53 separate discussions. He expects these modifications to be split into three or four groups, which results in a more efficient, omitted, open revision process, given the overlap of many.

If Barr’s estimate is correct, the bill will be passed before the end of this month. If so, its importance will be important for the larger crypto industry.

Understanding the impact of Stablecoin

Stablecoins are undoubtedly the most globally adopted digital asset. Unlike traditional cryptocurrencies such as Bitcoin and altcoin, they provide global access to stable mediums of exchange.

According to a January report from Crypto Exchange CEX.IO, the total amount of Stablecoin transactions reached 27.6 trillion in 2024, exceeding Visa’s total payment volume and Mastercard by 7.7%.

Tether and Circle dominate the market with $151 billion and $59 billion, respectively. According to RWA.xyz, they have an 89% market share together.

Their heavyweight presence in the global economy makes bills more important than ever. This is especially true in the debilitating US dollar context.

The impact of the decline of the dollar

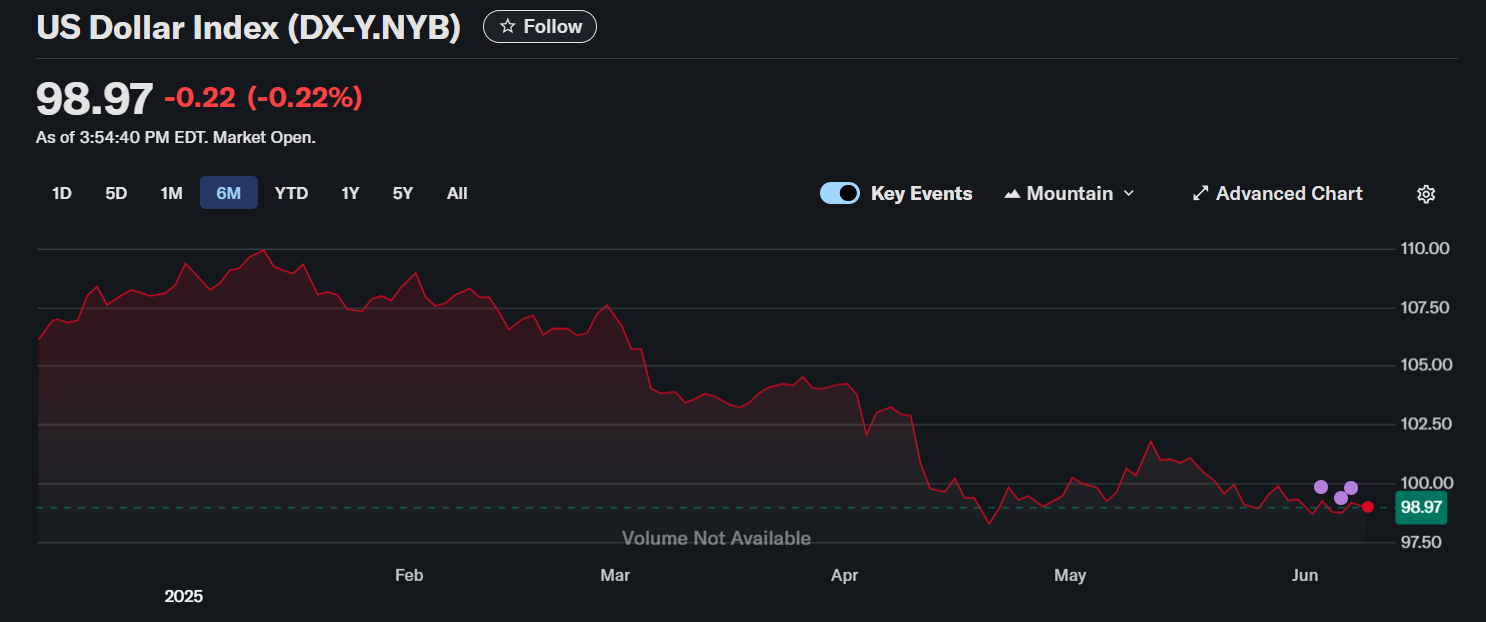

The US dollar started the year very weakly. Two days ago, the US Dollar Index (DXY) (an important measure strongly affected by the euro’s impact) reached a measurement of nearly 9% to under 99 years of age. The results marked the weakest calendar year at least since the mid-1980s.

In the face of this data, along with ongoing trade uncertainty and fear of recession, investors are fundamentally reassessing the role of the dollar in their portfolios.

This situation and the broader decoupling of major US debtors such as China and Japan have heightened concerns about the future of the dollar.

Data from ARK Invest shows this shift. In 2011, these three countries held 23% of US Treasury debt, $10.1 trillion.

By November 2024, their total holdings had dropped significantly to about 6%, despite the US Treasury’s total debt rising to $36 trillion.

This substantial decline in holdings by major foreign creditors underscores growing concerns about the long-term stability of the dollar and the US’s ability to refinance large debts.

“The dollar is the global reserve currency. At the sovereign level, demand for the dollar has declined. In recent years, the Treasury’s largest buyer has reduced its Treasury holdings.

Klaich added that laws like genius acts are important.

“In my opinion, there is little more important than the stable coin bill inherited from a macroeconomic perspective. If demand for the dollar decreases at the sovereign level, if it can replace demand at the retail individual level, then structurally speaking, it is a huge boon for the US government.”

The data behind Klaich’s statement appears to support his analysis.

What role will Stablecoins play in future US debt demand?

The Stablecoin market is growing significantly. A report from Citigroup in April shows that total security supply could reach $1.6 trillion by 2030. This growth could create demand for US debt comparable to the historical levels supported by sovereign countries.

Genius acts can drive this transition.

“Hopefully, once it passes, demand for stubcoins explodes because there are many businesses and banks planning on introducing subscription coins that provide rails for them to operate at the consumer and business level.

By serving communities and people that are neglected or undermined by traditional banking systems, Stablecoins could also help offset global decommunal movements.

“Everyone in the world will have access to the US dollar. What is given to the US from an economic warfare perspective is important,” Klaich added.

Due to the sustained risk of inflation, the Federal Reserve is unlikely to buy back a significant amount of the US Treasury. Therefore, by encouraging the use of Stablecoin, this market can effectively replace financial mechanisms that are currently ineffective.

Amendment to the bill

If the Genius Act is implemented correctly, the Stablecoin industry could be a valuable financial tool for the US government to ensure long-term support for the US dollar.

The bill went through a difficult revision process. According to Barr, the process was boring and politically challenging.

“Looking at all the progress we have made, we have now worked on three legislatures, and we have been working on this.

However, multiple revisions were prerequisites for its passage to ensure that the bill handled issues of consumer protection, national security and market integrity responsibly.

Klaich noted that these important concerns have been addressed considerably in the legislative process. He emphasized that recent versions of the bill effectively integrated these revisions.

“None of these issues are existential and are negotiated with the latest version of the bill currently being considered.

The future will reveal whether the bill will pass and achieve the desired effect of helping the US overcome its complicated economic realities.

Disclaimer

Following Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. Although Beincrypto is dedicated to transparent reporting, the views expressed in this article do not necessarily reflect the views of Beincrypto or its staff. Readers should independently verify the information and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.