Binance founder and former CEO Changpeng Zhao (CZ) recently proposed a triple or 10x reduction in BSC gas fees. Just 24 hours later, Binance Smart Chain reduced gas prices by 10 times, achieving a 90% reduction. Movement Builders and users helped at a large scale.

Beincrypto’s exclusive, BNB chain core development team categorizes the story behind the dramatic 90% gas rate cuts. Moving from one GWEI to 0.1 GWEI clarify the governance mechanisms, market incentives, and changing locations of chains in the Layer-1 vs Layer 2 stack war.

CZ may have lit a spark, but the validator controls the fire

The Binance Smart Chain’s gas rate story has been pinned quickly to one catalyst from 1 GWEI to 0.1 GWEI. Tweet from BinanceFounderChangpeng Zhao.

This is in a space often dominated by headlines. But behind the scenes, something deeper unfolds.

Validator-driven readjustment of network pricing dynamics is consistent with the strategic drive that will entrench the role of BNB chains in the future of multi-layered and scalable blockchains.

Speaking solely to Beincrypto, a spokesman for BNB Chaincore Development has dispelled the notion that this is a top-down order from Changpeng Zhao.

“Minimum gas pricing is not part of the consensus mechanism, so it’s dynamic in the markets that the validators have chosen. The Validator community responds to calls from the CZ, but ultimately it’s their decision,” the spokesman said.

In other words, CZ’s call sparked debate, but the final lever pull came from the validator. Validators consist of balancing distributed groups that balance network demand, block space supply, and protocol economics.

It’s not about rival chains, it’s about market efficiency.

The benefits of Ethereum’s Layer-2 rollup and Solana fees did not stimulate a 90% reduction BSC gas fees. Instead, changing the validator sentiment and user expectations facilitated this decision.

“It’s driven by the dynamics of the community and block space market. It’s not universally enforced. Some daps and platforms still use higher pricing,” the spokesman added.

The warning that gas prices are not evenly down between tools and DAPP explains whether some users are still not feeling the impact.

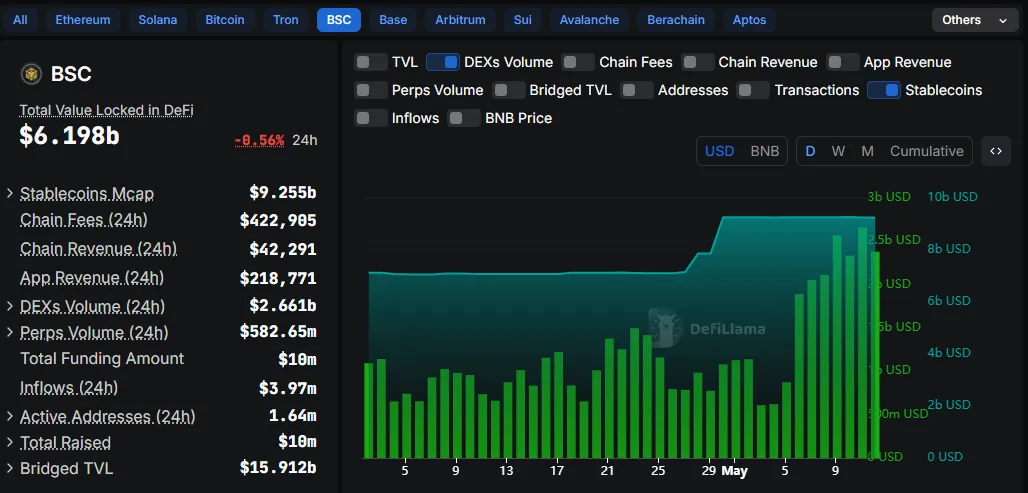

Still, the metrics suggest that momentum is being built. BSC has seen a recent surge in decentralized exchange (DEX) transactions and Stablecoin transfers, independent of the latest fee changes.

BSC + OPBNB: 2 layers, 1 vision

BSC continues to lock the BNB ecosystem, but the actual master strokes lie in its layered architecture. OPBNB, a fast layer 2 in the network, targets 10,000 transactions per second (TPS) and subcent costs. Sets the stage where the BNB chain spans the battlefields of L1 and L2.

“The BNB chain ecosystem is positioned not only as a single competitor L1, but as a network that offers scalable solutions on different layers. OPBNB can compete in L2 domains with L2 domains as BSC remains a robust base layer,” the team said.

This duality is becoming the norm among major chains seeking mass adoption, a resilient base and scalable layer. According to the BNB Chain Core Development team, the BNB chain is perfectly aligned with its paper.

Sustainable or temporary? Validators keep dials

0.1 Is GWEI sustainable? It depends on the network load and the sentiment of the validator. The average BSC is only 20% capacity utilization, so the risk of congestion appears to be low. Still, the pricing is not fixed, but it’s an organic mechanism.

“Pricing is a separate market selection from the validator. They need to adjust it according to the ever-changing market conditions,” the spokesman said.

This market-driven model could be the secret weapon of the BNB chain. It is adjustable, scalable and community sensitive.

What began as a virus proposal from the founders of Binance matured into a community coordination response that reflected the adaptive architecture and governance of the BNB chain.

With Defi, Stablecoins and large capacity Dapps gaining traction and Opbnb is poised to charge throughput, 90% rate slashes are more about growth than just costs.

The BNB token has traded at $665.49 at the time of this writing, an uptick in 1.48% over the past 24 hours.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.