The Spot Bitcoin ETF registered another day of influx on Thursday, coinciding with a rally of coins that surpassed the $100,000 mark for the first time since February.

No major ETFs saw spills during yesterday’s session, confirming new institutional trust in the long-term trajectory of the assets.

Bitcoin ETF sees another day of inflow

Yesterday, the Bitcoin-backed ETF recorded a net inflow of $117.46 million, down 17% from the previous day’s $142.31 million. A small dip could reflect profits after BTC surges above $100,000, but the ongoing inflow still shows investors’ confidence in major cryptocurrencies.

On Thursday, BlackRock’s iShares Bitcoin Trust (IBIT) led the trend, posting the best daily influx among all ETF publishers. The fund recorded a net inflow of $69 million that day, boosting its total historic net inflow to $443.5 billion.

Fidelity’s ETF, FBTC, came in second in a daily net inflow of $3,534 million. The total historic net inflow is currently $11.67 billion.

In particular, none of the 12 ETFs recorded internet leaks yesterday.

BTC Rally Fuels Futures Frenzy

BTC’s break above the psychological six-figure threshold during Thursday’s trading session rekindled bullish momentum across the market.

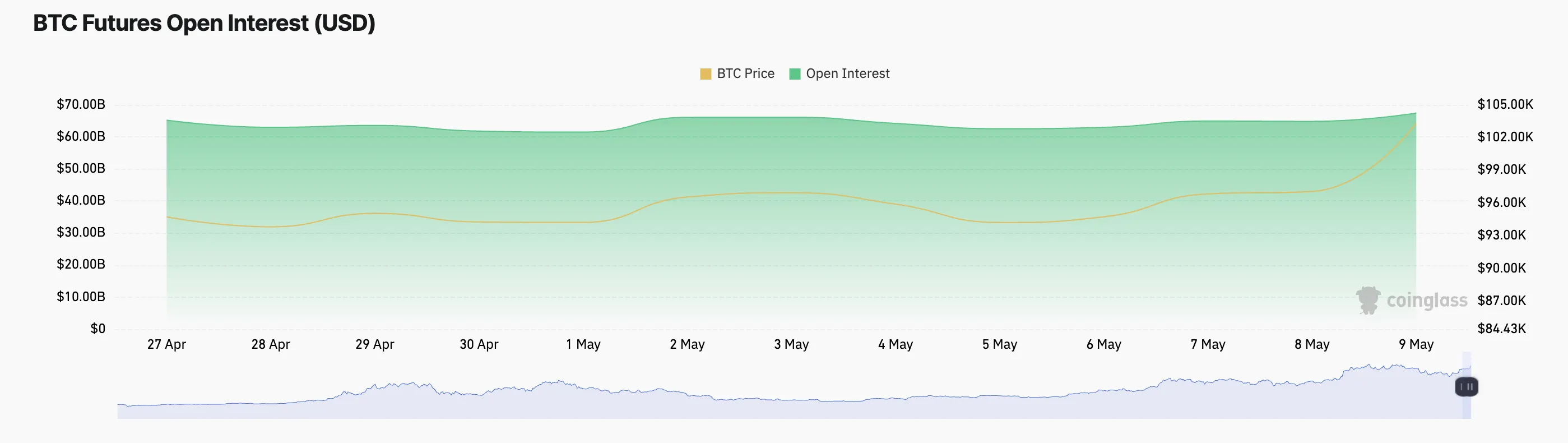

This is reflected in open profits in Coin’s futures, which is currently at $67.45 billion, up 5% in the past day. As the open interest on assets rises along the price, new money enters the market to support the trend, showing strong bullish momentum.

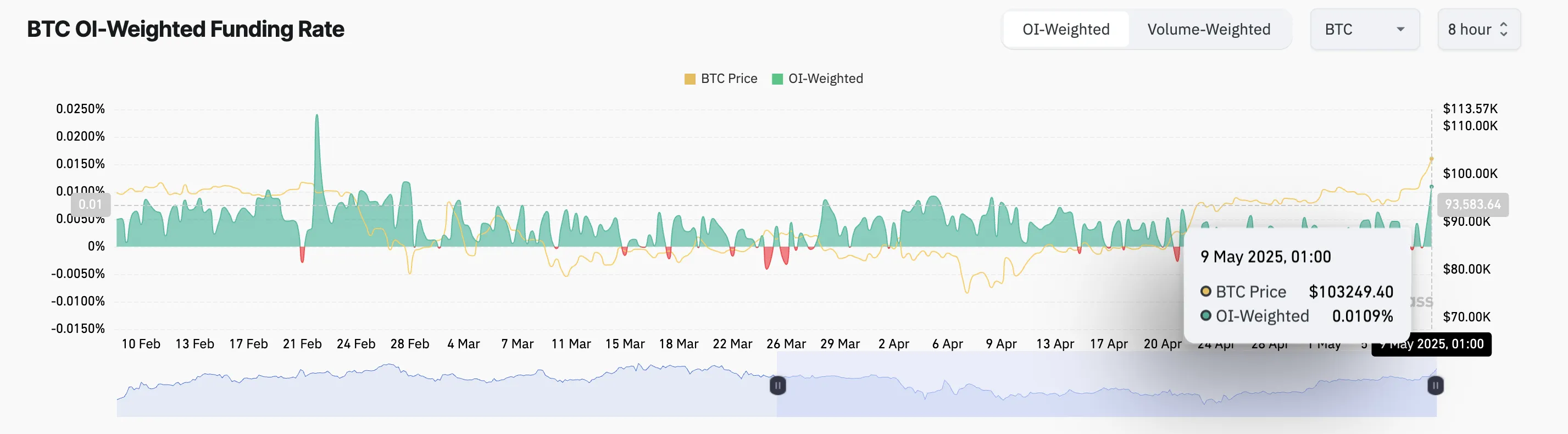

Furthermore, BTC’s funding rate has skyrocketed to its highest level since February 28th, reflecting months of high demand for long positions among futures traders. At the time of writing, the metric is 0.0109%.

Such a high funding rate means that traders are paying premiums to keep their long standing in trade.

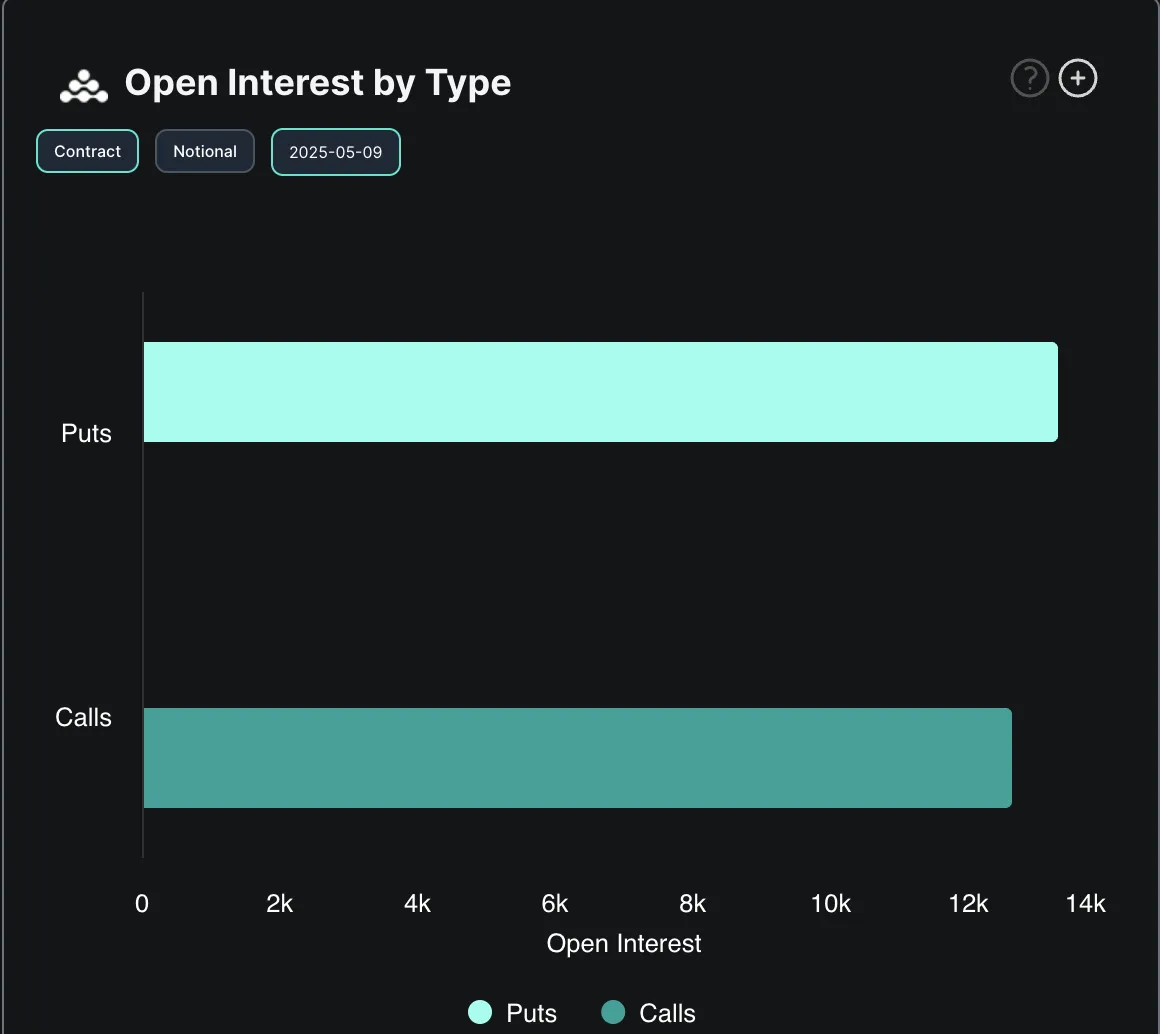

However, while ETF investors and futures traders appear to be bullish, the options market shows signs of caution. The data shows that there is an increasing demand for downside protection as activity around the Put option increases.

Mixed sentiment can shape short-term price action as the market digests BTC rally over $100,000 and evaluates whether it can continue.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.