The final true altcoin season happened in 2017, when most altcoins were surged. A similar cycle did not repeat in 2021 or 2025, according to analyst Michael Van de Poppe.

The market is now the “Bitcoin season” with Altcoin season index below 25, far from the 75 required for the Altcoin season.

It was underestimated to monitor the next big cycle

Michael Van de Poppe traced the final ALT season back in 2017 when altcoins like Ethereum and Ripple had grown enormously. However, he said 2021 only saw a surge in new altcoins, and that 2025 is dominated by “Meme Coin Fiesta.”

“This cycle has proven to be quite different from the previous cycles and is extremely complicated,” said Michael Van de Poppe.

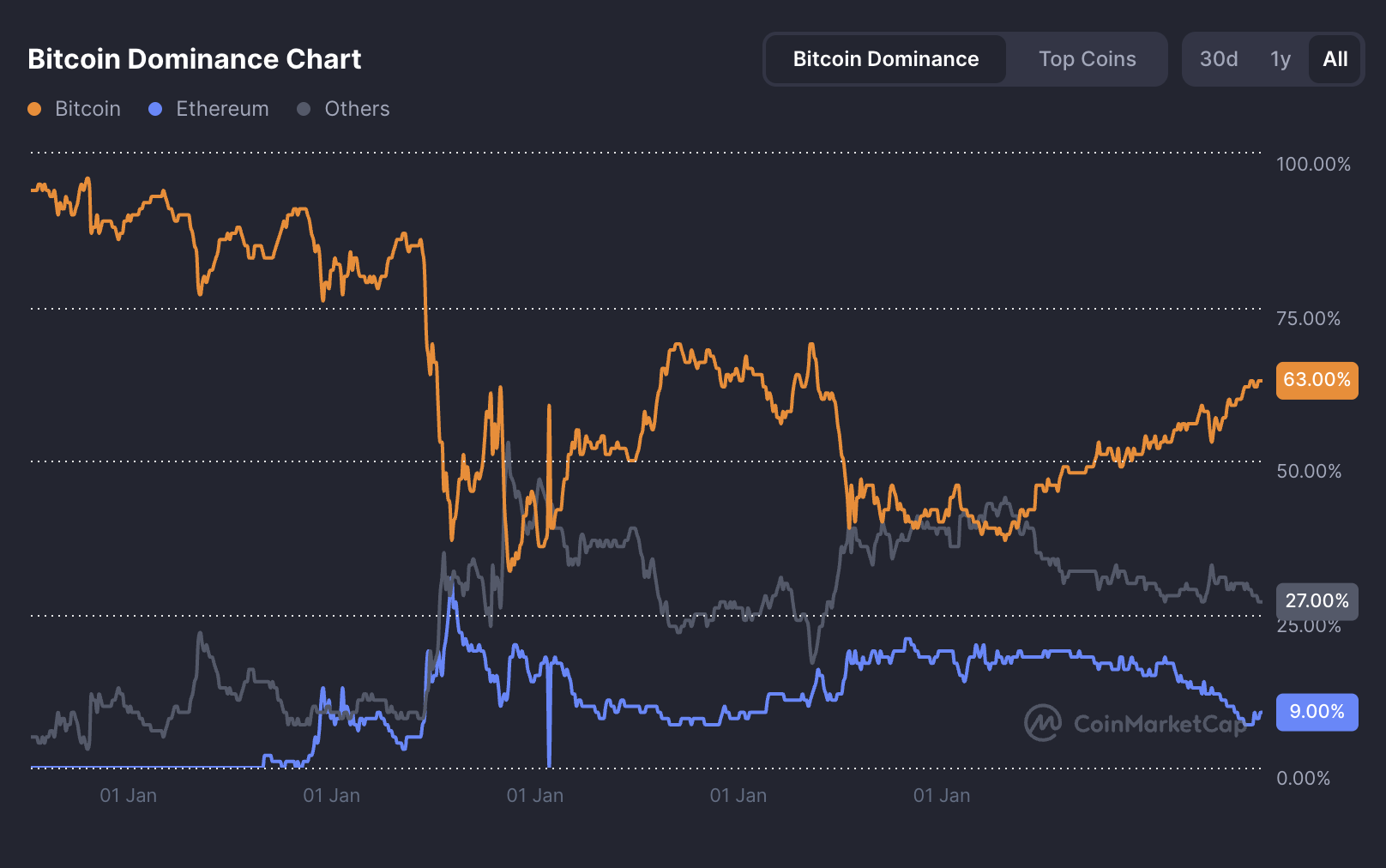

Blockchain Centre’s Altcoin Season Index Chart clearly illustrates this trend. The index has been below 50 throughout most of 2024 and 2025, highlighting the advantage of Bitcoin. According to Coinmarketcap, Bitcoin’s advantage is currently at 63%, much higher than the 38% in the 2017-2018 ALT season.

Van de Poppe also pointed to a division in the investor community. One group expects the bear market to continue, while another expects a new bull cycle. He believes that both groups could be wrong. Instead, he suggests that the real opportunity lies in ignoring “timing” and focusing on the core values of the altcoin.

“Essentially, the difficulty of this cycle has increased dramatically, and it’s almost foolish to build your whole paper on what happened,” Michael Van de Poppe said.

Macroeconomic factors play an important role in shaping the Altcoin season. Van de Poppe noted that risk appetite will be coming back, especially as Altcoins are better than Bitcoin due to falling interest rates and lower US dollars. Furthermore, advances in the defi ecosystem and the widespread adoption of altcoins like Ethereum are positive signs.

“It’s a time when the alto season is so underrated for me, but I can scoop up Altcoins, who have a strong team that’s resilient and keeps building. There’s a lot out there, and these are so, very, very underrated,” Michael Van de Poppe said.

Rather than chasing short-term trends, investors should remain cautious about projects with strong teams and solid foundations. Given the current market, long-term investment strategies and thorough analysis are key to taking advantage of the upcoming season.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.