The crypto market in 2025 is facing intense turbulence. Capitals on one trend like Meme Coins have plummeted. Capital is flowing out of Decentralized Financial (DEFI) protocols, reducing Defi’s total value (TVL) from $120 billion to about $87 billion.

In this regard, Sonic stands out. It consistently hit New TVL Highs, growing nearly 40 times the start of the year before reaching $1 billion in April. So why is it making Sonic a bright spot in the storm market?

Investors are pouring capital into Sonic

Sonic has made its mark with faster TVL growth rates, far surpassing the better-known blockchain. According to Defillama, Sonic reached $1 billion on TVL within 66 days. In comparison, the SUI took 505 days and APTOS required a 709.

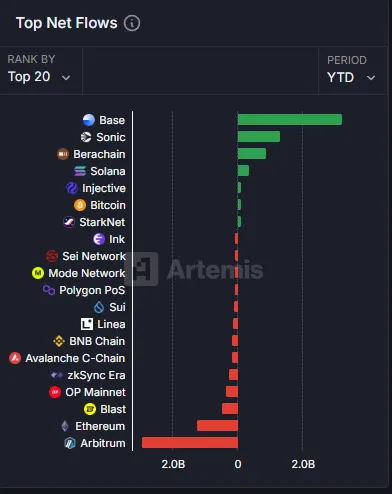

This achievement reflects a strong capital inflow into the Sonic ecosystem despite a broader negative trend in capital withdrawal. Data from Artemis supports this, and Sonic ranks it as the second highest Netflow protocol this year. We only trail Base, a blockchain backed by Coinbase.

Growth exceeds the number of TVLs. Sonic’s Ecosystem attracts a variety of projects, including derivative exchanges such as Aark Digital and Shadow Exchange, as well as protocols such as Snake Finance, Equalizer0X, and Beets. Although these projects still have small TVLs, they could spur Sonic’s momentum and pull new users and capital.

But the problem remains. Can this capital inflow remain sustainable while the market is fluctuating?

Andre Cronge on Sonic’s possibilities and strengths

Sonic developer Andre Cronje shared his ambitions in an interview to push this blockchain beyond its competitors.

“Sonic has a lower finality of 200 milliseconds than a human response,” Andre Crongier said.

According to Cronje, Sonic is not just about speed. The platform also focuses on improving both the user and developer experience. He explained that 90% of the transaction fee will be sent to DAPP rather than to Valitter, creating an incentive for developers to build.

Unlike other blockchains such as Ethereum, which are limited by long block times, Sonic takes advantage of an enhanced virtual machine that in theory handles transactions up to 400,000 seconds. However, Cronje acknowledges that current demand has not yet pushed the network to its full potential. Still, these technical advantages make Sonic a compelling option for developers looking for more user-friendly Dapps.

He also revealed new features from Sonic that could attract users.

“If the first touchpoint using a user downloads this wallet and then purchases this token in exchange, you will lose 99.9% of users. They do not need to access and interact with DAPP using Google Off-Mail passwords, fingerprints, faces, etc.

Future risks and challenges

Despite reaching an impressive milestone, Sonic is not affected by risk. The token price, S, has dropped significantly from its peak. According to Beincrypto, it has dropped by around 20% in the past month from $0.60 to $0.47, adopting wider market volatility.

Additionally, Grayscale recently removed Sonic from its April asset consideration list. The decision reflects a shift in the fund’s expectations and raises concerns about Sonic’s ability to maintain TVL if investors’ feelings get worse.

Sonic also faces intense competition from other high-performance chains such as Solana and Bass. Sonic has distinct advantages in speed, but long-term user recruitment depends on whether its ecosystem can bring real value, not just the height of the TVL.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.