Crypto US stocks focus today on Coinbase (Coin), Strategy Incorporated (MSTR) and Mara Holdings (Mara) responding to key revenues and Bitcoin milestones.

Coin surprised traders by shutting down 5.06% despite lack of first-quarter revenue and EPS expectations. MSTR continues to surge along with Bitcoin, and its holdings are currently worth nearly $54 billion. Meanwhile, Mara jumped 7.20% after imposing strong revenue growth and outlined a strategic shift towards digital energy infrastructure.

Coinbase (coin)

Coinbase’s first quarter 2025 revenue report released yesterday did not meet market expectations. Revenue fell below forecast to nearly $200 million, with EPS falling to just $0.24 against the expected $2.09. Transaction revenue was overlooked at $70 million, and subscription and service revenue was not short.

Despite these numbers, there were some bright spots. Trading volumes slightly beat expectations, with USDC balance held in Coinbase products jumping to $12.3 billion per quarter, 49%.

The company also highlighted its long-term growth outlook as reasons to keep the Delibit acquisition, regulatory victory in India and Argentina and the recent SEC incident optimistic about the future.

Despite its bearish finances, Coinstock increased the day by 5.06%, indicating that investors may be focusing on the broader strategic positioning of the platform rather than short-term unperformance.

In the pre-market market, stocks fell 1.46%, but they beat the major resistance level at $206.9. If the coin can hold above that level, the next upward target is about $214.77.

However, if you can’t maintain this support, your inventory could slide to $194.

Strategic Corporation (MSTR)

The previous micro strategy continues to rise as Bitcoin exceeds $100,000. MSTR stocks rose nearly 75% last month, strengthened by a surge in Bitcoin value and a growing confidence in the company’s aggressive crypto strategy.

Despite reporting a net loss of $4.2 billion in the first quarter and facing criticism of its debt, the strategy remains lenient to BTC accumulation.

As a result, its Bitcoin Holdings reached a record $53.9 billion, up 50.1% from its cost base, making it the most prominent company holder and an important pillar of market sentiment.

Momentum was brought into the latest session, with MSTR closing at 5.58% yesterday, earning an additional 1.81% in the pre-market market. The stock has now surpassed recent levels and is now seeing its $437 mark as its next potential upward target.

However, this rally is heavily linked to Bitcoin’s price trajectory. MSTR can test support for $404 if momentum stalls.

A break below that level could cause a deeper pullback to $383, making it a key area for the Bulls to defend in the short term.

Mara Holdings (Mara)

Mara Holdings recorded revenues of $213.9 million for the first quarter of 2025, up from $165.2 million in the first quarter of 2024. Growth comes from a 77% increase in the average Bitcoin price.

The company produced 525 fewer BTC than last year, mainly for half. Still, Block’s victory was 81%, with BTC Holdings jumping to 47,531, currently worth around $3.9 billion.

Despite this, Mara reported a net loss of $533.4 million. This showed a 258% decline in revenue due to a decline in BTC prices at the end of the quarter.

Mara has shifted its focus to become a vertically integrated digital energy and infrastructure company. It invests in low-cost renewables, including Texas’ 114 MW wind farms.

Stocks rose 7.20% yesterday, with strong investors’ interest. However, pre-market trading saw a 1.68% decline.

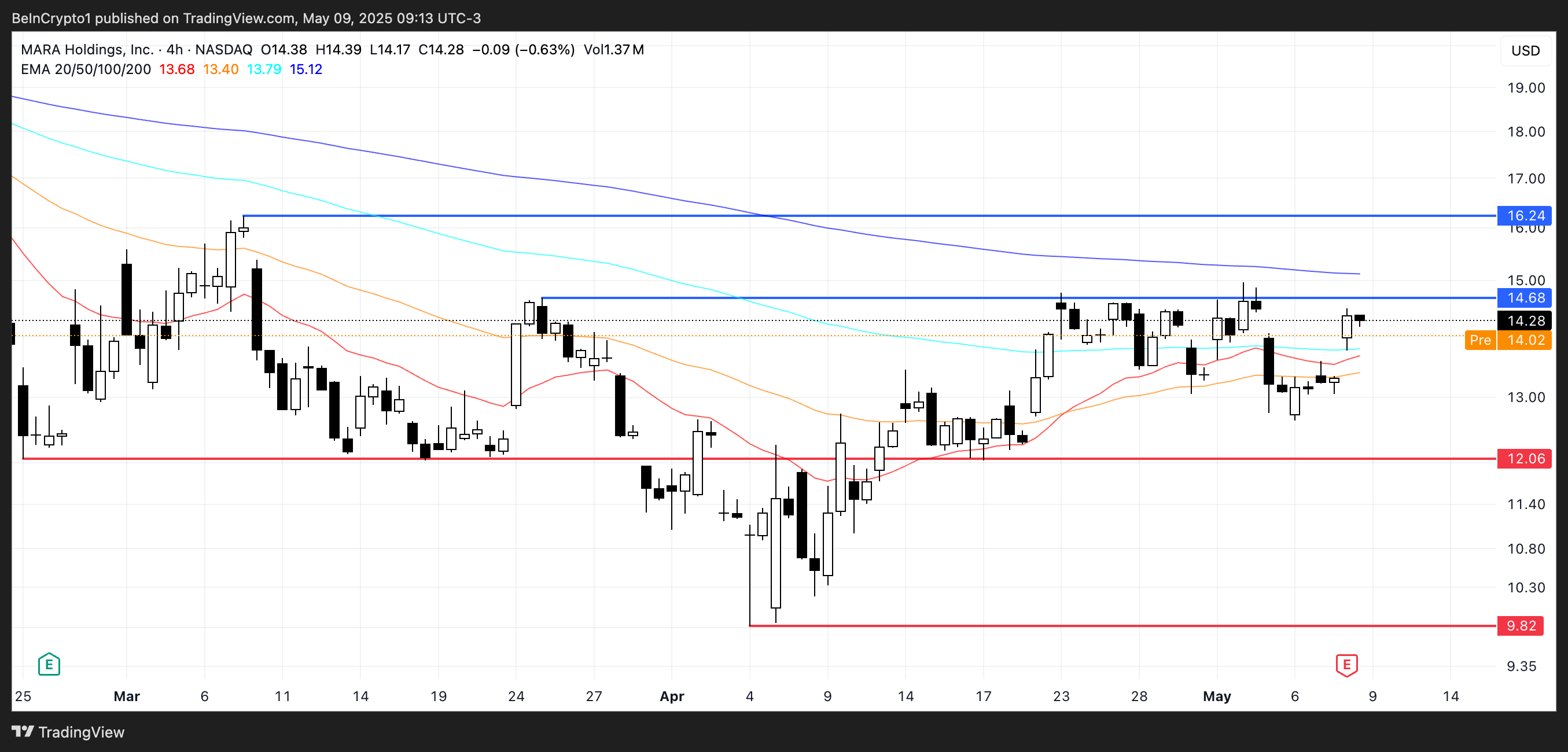

Mara is approaching important resistance at $14.68. If it breaks it could rise to $16.24. If the trend is reversed, support is $12.06. A drop below that could send it to $9.82.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.